Homer County Has Until September 8 to Protest Your Taxes

O'Connor discusses how Homer County property owners have until September 8 to protest property taxes.

CHICAGO, IL, UNITED STATES, September 8, 2025 /EINPresswire.com/ --Will County has risen in recent decades as the premier suburban area to live in the greater Chicago area. While DuPage County has the most exclusive neighborhoods, Will County has a wider range of environments and demographics. With some of the most beautiful parks in the nation, its rural charm, suburban amenities, and growing urban infrastructure, Will County continues to draw in people migrating from Cook County. As Chicagoland as a whole keeps growing, more and more people are making their homes in places like Joliet, Naperville, and Plainfield.

Sharing a border with Cook County, Homer Township is close enough for commuters to live, while still having a rural feel. Located perfectly to act as a hub for other cities as well, the villages and towns of Homer Township are starting to see a growing influx of people. This has driven up the demand for housing and business real estate, which in turn has raised assessed values. Will County has some of the highest property tax rates in the nation and every percentage hike in valuation means hundreds or thousands of dollars are added to a tax bill each year. Property tax appeals are a growing tradition in Chicagoland and are the only way to fight skyrocketing costs. The final deadline in Homer Township to file one of these vital protests is September 8, 2025.

Homer Township Homes Add 8% to Value

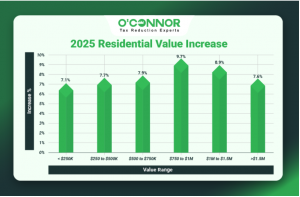

Like many townships in Will County, Homer is mainly built around residential properties rather than commercial ones. While business real estate in the township is doing quite well, it is homes that steal the show on the balance sheet. In 2024, Homer Township homes had a combined value of $6.15 billion. In 2025, after an overall increase of 8%, this number was $6.64 billion. This is a tremendous jump in value for a year outside of an official reassessment, but the Homer Township Assessor is always making adjustments based on the past three years of home sales. When paired with the high tax rates of Will County, this already giant spike could result in some of the highest tax bills in Illinois.

Like most of its neighbors, Homer Township’s residential values are centered around moderate to medium homes. The largest block of value was for homes worth between $250,000 and $500,000. These totaled $3.11 billion in 2025, after an increase of 8%. In second place were those assessed from $500,000 to $750,000, with a total of $2.42 billion. These residences likewise grew by 8%. A slightly smaller increase of 7% was experienced by homes worth under $250,000, though they totaled a moderate $266.86 million.

When it comes to pure percentage, high-value homes and luxury properties experienced the largest increases. Those assessed from $750,000 to $1 million saw a jump of 10%, the highest experienced by any category. This brought their total to $592.37 million, making them third place in the township. Luxury properties worth between $1 million and $1.5 million increased by 9%, growing to $175.96 million. Finally, truly massive homes worth more than $1.5 million saw a rise of 8%, which meant a combined value of $76.10 million.

How Homer Stacks up with Other Townships

While an 8% increase in residential properties has a huge impact on possible taxes, Homer is toward the middle of the pack when it comes to 2025 rises. The 8% figure puts them in the company of the likes of Lake County’s Waukegan at 8% and Wauconda at 7%. Meanwhile, Kane County had townships such as Batavia, Geneva, and Rutland experiencing 9% increases, while Aurora felt the sting of a 10% jump. McHenry County saw some of the largest, with 11% for Dorr and Richmond townships. The fellow Will County township of Joliet added 10% to their total, while Plainfield grew by 8%.

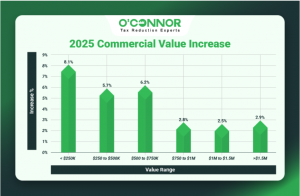

Commercial Property Experiences an Uptick of 3%

While homes were certainly overvalued at $6.64 billion, they still easily overshowed the combined total for commercial properties, which was $988.60 million. This was still a strong total for Homer Township businesses and could be another case of overassessment. There has been a recent movement in Illinois to lay the tax burden on businesses rather than homeowners. This varies from county to county and even between townships. It appears that Will County is not following this trend, but it could be because of how the community is composed. Commercial property added 3% in total value in 2025, which is below what most collar counties see.

$707.69 million in value was created by business properties worth over $1.5 million. While this is the usual trend across the nation, it is rare for a single category of property to be responsible for that much of the total. This seems to be a common theme for Will County, outside of Joliet, and may just be a twist unique to the area. This puts an outsized importance on these large commercial properties, which means any adjustment to them will have a huge impact on the community. These elite properties added 3% to their total in 2025. This relatively small bump is why the overall average stayed so low.

This 3% growth rate also applied to the next tier of businesses, which were those worth between $750,000 and $1.5 million. Things got more interesting with smaller commercial properties, as there were a variety of changes. Those worth between $500,000 and $750,000 notched an increase of 6%, while those assessed from $250,000 to $500,000 followed suit. Commercial properties worth less than $250,000 were hit with an 8% increase, the highest rise of all, even if they only totaled $33.75 million.

You Have Until September 8 to Protest Your Taxes

Despite Cook County hogging all of the spotlight, Will County has some of the highest property taxes in the United States. This is due to many reasons, including overassessment, numerous government agencies in need of funding, and even general incompetence by assessors. It is estimated that a homeowner may pay nearly 6% of the yearly income just to satisfy property taxes, and this can be easily exacerbated by increasing assessments. There is nothing a taxpayer can do to lower tax rates, as these are set by many different bodies. However, it is in the power of a taxpayer to lower their assessed value.

Exemptions and property tax appeals are the only two ways to accomplish this. Exemptions are a good start, and every business or homeowner should have these applied by default if possible. Appeals or protests take extra work but are quickly becoming requirements to protect homes and businesses. This is because they are the only way to keep the assessor honest, as they force a second look at a property’s fair market value. This allows any errors to be fixed and possibly also corrects unfair valuations.

Informal appeals to the assessor allow basic corrections and are an important first step. These are often enough to get a settlement and a reduction in taxable value. If this is rejected by the assessor or deemed insufficient by the taxpayer, then the next step is a hearing before the Board of Review (BOR). These formal hearings with the BOR are picking up steam in Illinois, especially in the collar counties, and are breaking records every year. Outside of Cook County, taxpayers have a single deadline for both appeal types. This means that a taxpayer must file before the final cut-off date if they wish to attempt to lower their taxes. The deadline for Homer Township is September 8, 2025, as it is for most of Will County.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Illinois, Texas, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

LinkedIn

Facebook

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.