Mobile Phone Insurance Market In 2029

The Business Research Company's Mobile Phone Insurance Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, January 6, 2026 /EINPresswire.com/ -- "Mobile Phone Insurance Market to Surpass $70 billion in 2029. In comparison, the Property & Casualty Insurance market, which is considered as its parent market, is expected to be approximately $3,265 billion by 2029, with Mobile Phone Insurance to represent around 2% of the parent market. Within the broader Financial Services industry, which is expected to be $47,552 billion by 2029, the Mobile Phone Insurance market is estimated to account for nearly 0.1% of the total market value.

Which Will Be the Biggest Region in the Mobile Phone Insurance Market in 2029

North America will be the largest region in the mobile phone insurance market in 2029, valued at $20,235 million. The market is expected to grow from $12,426 million in 2024 at a compound annual growth rate (CAGR) of 10%. The strong growth can be attributed to the increasing use of smartphones and the high number of internet users.

Which Will Be The Largest Country In The Global Mobile Phone Insurance Market In 2029?

The USA will be the largest country in the mobile phone insurance market in 2029, valued at $18,601 million. The market is expected to grow from $11,430 million in 2024 at a compound annual growth rate (CAGR) of 10%. The strong growth can be attributed to the rising prevalence of cyberattacks and increasing e-commerce.

Request a free sample of the Mobile Phone Insurance Market report

https://www.thebusinessresearchcompany.com/sample_request?id=9230&type=smp

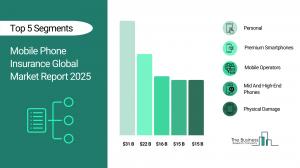

What will be Largest Segment in the Mobile Phone Insurance Market in 2029?

The mobile phone insurance market is segmented by phone type into budget phones, mid and high-end phones and premium smartphones. The premium smartphones market will be the largest segment of the mobile phone insurance market segmented by phone type, accounting for 54% or $37,800 million of the total in 2029. The premium smartphones market will be supported by factors such as the growing inclination towards luxury and status-symbol devices, increasing consumer focus on the latest technological innovations such as foldable screens and AI integration, higher purchasing power in developed markets, rising demand for superior aesthetics and design, increasing investment in the quality of camera features for photography enthusiasts and the popularity of high-end brand ecosystems (such as Apple’s iOS or Samsung’s Galaxy range) that offer seamless device integration.

The mobile phone insurance market is segmented by coverage into physical damage, internal component failure, theft and loss protection, virus and data protection and other coverages. The physical damage market will be the largest segment of the mobile phone insurance market segmented by coverage, accounting for 32% or $22,649 million of the total in 2029. The physical damage market will be supported by factors like the increasing number of accidental drops and screen damages, growing awareness of mobile phone insurance options, rising consumer demand for extended device protection services, higher smartphone penetration leading to more devices at risk of physical damage and advancements in smartphone durability driving insurance options for high-value devices.

The mobile phone insurance market is segmented by distribution channel into mobile operators, device OEMs (original equipment manufacturers), retailers, online and other distribution channels. The mobile operators’ market will be the largest segment of the mobile phone insurance market segmented by distribution channel, accounting for 33% or $23,332 million of the total in 2029. The mobile operators market will be supported by factors like the close relationship between mobile operators and consumers, allowing operators to bundle protection plans with mobile phone subscriptions, the growing number of consumers purchasing devices through mobile operators who often offer insurance packages, the rise of operator-exclusive mobile protection deals, increasing consumer trust in mobile operators as reliable service providers for insurance and the convenience of purchasing insurance directly from a mobile operator during the device purchase process.

The mobile phone insurance market is segmented by end user into corporate and personal. The personal market will be the largest segment of the mobile phone insurance market segmented by end user, accounting for 70% or $48,783 million of the total in 2029. The personal market will be supported by factors such as the growing number of individual consumers investing in high-value smartphones, the increasing consumer awareness about the risks of damage and theft, the rising demand for extended warranties and mobile insurance coverage, the need to protect personal data and privacy stored on mobile devices, the increasing frequency of mobile phone upgrades and the growing preference for mobile phones as an essential part of personal and professional life, which drives the demand for comprehensive protection plans.

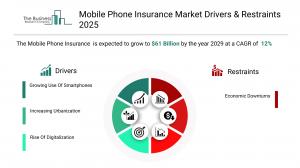

What is the expected CAGR for the Mobile Phone Insurance Market leading up to 2029?

The expected CAGR for the mobile phone insurance market leading up to 2029 is 12%.

What Will Be The Growth Driving Factors In The Global Mobile Phone Insurance Market In The Forecast Period?

The rapid growth of the global mobile phone insurance market leading up to 2029 will be driven by the following key factors that are expected to reshape consumer protection, device lifecycle management, and the economics of device ownership worldwide.

Growing Use Of Smartphones- The growing use of smartphones will become a key driver of growth in the mobile phone insurance market by 2029. As smartphones become increasingly essential in daily life for communication, work, entertainment, and financial transactions, their value and importance have risen significantly. This widespread adoption leads to a higher likelihood of accidental damage, theft, or loss, prompting consumers to seek protection through insurance. As a result, the growing use of smartphones is anticipated to contributing to annual growth in the market.

Increasing Urbanization- The increasing urbanization will emerge as a major factor driving the expansion of the mobile phone insurance market by 2029. In urban areas, higher population density and a fast-paced lifestyle increase the risk of phone theft, damage, or loss due to frequent usage and commuting. Additionally, urban dwellers often have higher disposable incomes and are more tech-savvy, making them more likely to invest in smartphones and protective services like insurance. As a result, the increasing urbanization is anticipated to contributing to annual growth in the market.

Rise Of Digitalization- The rise of digitalizations will serve as a key growth catalyst for the mobile phone insurance market by 2029, As more aspects of daily life move online, consumers increasingly rely on digital platforms for purchasing and managing mobile phone insurance. Digitalization enables insurers to offer personalized policies, quick online claims processing, and automated customer support through apps and websites. Additionally, digital tools facilitate seamless integration of mobile phone insurance with smartphone purchases and digital payment systems, making it more convenient for consumers to protect their devices. As a result, the rise of digitalizations is anticipated to contributing to annual growth in the market.

Expansion Of Insurtech Sector- The expansion of insurtech sector will become a significant driver contributing to the growth of the mobile phone insurance market by 2029 Insurtech companies leverage technology to streamline the insurance process, from simplified policy purchases and claims filing to personalized offerings and real-time customer support. Through mobile apps and digital platforms, insurtech companies can offer tailored mobile phone insurance policies, enhancing convenience and user experience. As a result, the expansion of insurtech sector is anticipated to contributing to annual growth in the market.

Expansion of E-commerce Platforms- The expansion of e-commerce platforms will become a significant driver contributing to the growth of the mobile phone insurance market by 2029 As more people purchase smartphones through online retailers, these platforms often offer insurance options as an add-on during the checkout process, making it convenient for consumers to protect their devices at the point of purchase. Additionally, the rise of e-commerce increases the visibility of mobile phone insurance providers, allowing consumers to compare different plans, read reviews, and make informed decisions from the comfort of their homes. As a result, the expansion of e-commerce platforms is anticipated to contributing to annual growth in the market.

Access the detailed Mobile Phone Insurance Market report here:

https://www.thebusinessresearchcompany.com/report/mobile-phone-insurance-global-market-report

What Are The Key Growth Opportunities In The Mobile Phone Insurance Market in 2029?

The most significant growth opportunities are anticipated in the personal mobile protection insurance market, the premium smartphone protection insurance market, the mobile phone damage insurance market, and the online mobile phone insurance market. Collectively, these segments are projected to contribute over $59 billion in market value by 2029, driven by the rising global adoption of high-value smartphones, the increasing incidence of device damage and theft, and the surge in digital-first insurance distribution platforms. This growth reflects the accelerating shift toward subscription-based protection plans, faster AI-enabled claims processing, and expanding partnerships between insurers, telecom operators, and device manufacturers. Together, these forces are reshaping the mobile insurance landscape by enabling seamless coverage, rapid claims resolution, and enhanced consumer affordability fuelling transformative expansion across the mobile protection and insurance industry.

The personal mobile protection insurance market by $21,107 million, the premium smartphone protection insurance market is projected to grow by $18,694 million, the mobile phone damage insurance market by $9,530 million, and the online mobile phone insurance market by $9,519 million over the next five years from 2024 to 2029.

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info"

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.